In a recent blog, I questioned whether CFOs consider the Chief Data Officer to be accretive or destructive to Enterprise Value.

Data Monetization efforts yield results across four dimensions:

- Grow Revenues

- Reduce Costs

- Manage Risks

- Improve Cash Flows

There is a potential fifth dimension in terms of Environmental, Social and Governance (ESG) but that is a topic for another day.

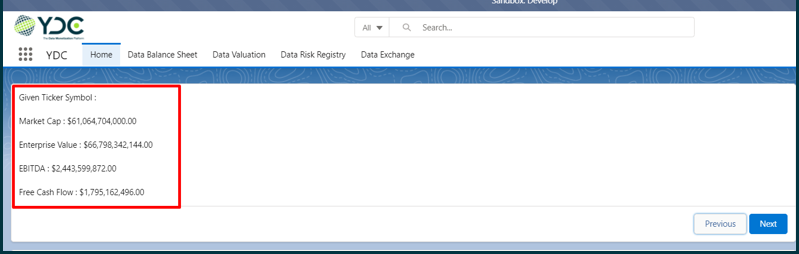

Each dimension has a different impact on the stock price. For example, Ford Motor Company (Ticker Symbol: F) has an Enterprise Value/EBITDA ratio of 8.27. Enterprise Value equals Equity Market Value Plus Long-Term Debt. EBITDA is Earnings before Interest Tax, Depreciation and Amortization. So, a dollar in cost savings due to data monetization results in an increase of $8.27 in Enterprise Value (essentially stock market value).

In the same vein, Ford’s Enterprise Value/Revenue ratio is 1.30. A data monetization business case that grows revenues by $10 million will result in an increase in Enterprise Value by $13 million.

Finally, Ford’s ratio of Enterprise Value/Free cash Flow is almost 7. This means that a data quality initiative that reduces Accounts Receivable by $50 million will increase Free Cash Flow by the same amount and will result in an

increase in Enterprise Value by $350 million.

increase in Enterprise Value by $350 million.

Data Management professionals need to become financially literate to be able to tie together these financial metrics in a way that makes sense to the CFO and the Board.

Our data monetization platform, YDC, ties together these business cases to create a Data Balance Sheet. The platform has an integration to Yahoo! Finance to ingest financial metrics based on the Ticker Symbol (see below).